Funding your business can be hard. We all need money to get started, but if you are a veteran there are some breaks available to you!

If you are a veteran who is now looking to run their own business, you could be missing out on thousands in grants and funding. We can’t show you how to apply to each one here, but we can let you in on some tips for grants that you could qualify for that can jumpstart your business ventures!

A good thing to discuss is the different kinds of domains for websites. Fraud and Scams are always a worry. When searching for grants, you should be looking for “.gov” websites. URLs ending in .gov are not just bought anywhere, only government bodies can obtain them. You should always be looking out for this when searching for and applying for grants!

Try checking your state and local government websites. For example, here is the NYC veterans’s grant page. Most states will have something like this that can really serve to boost your business.

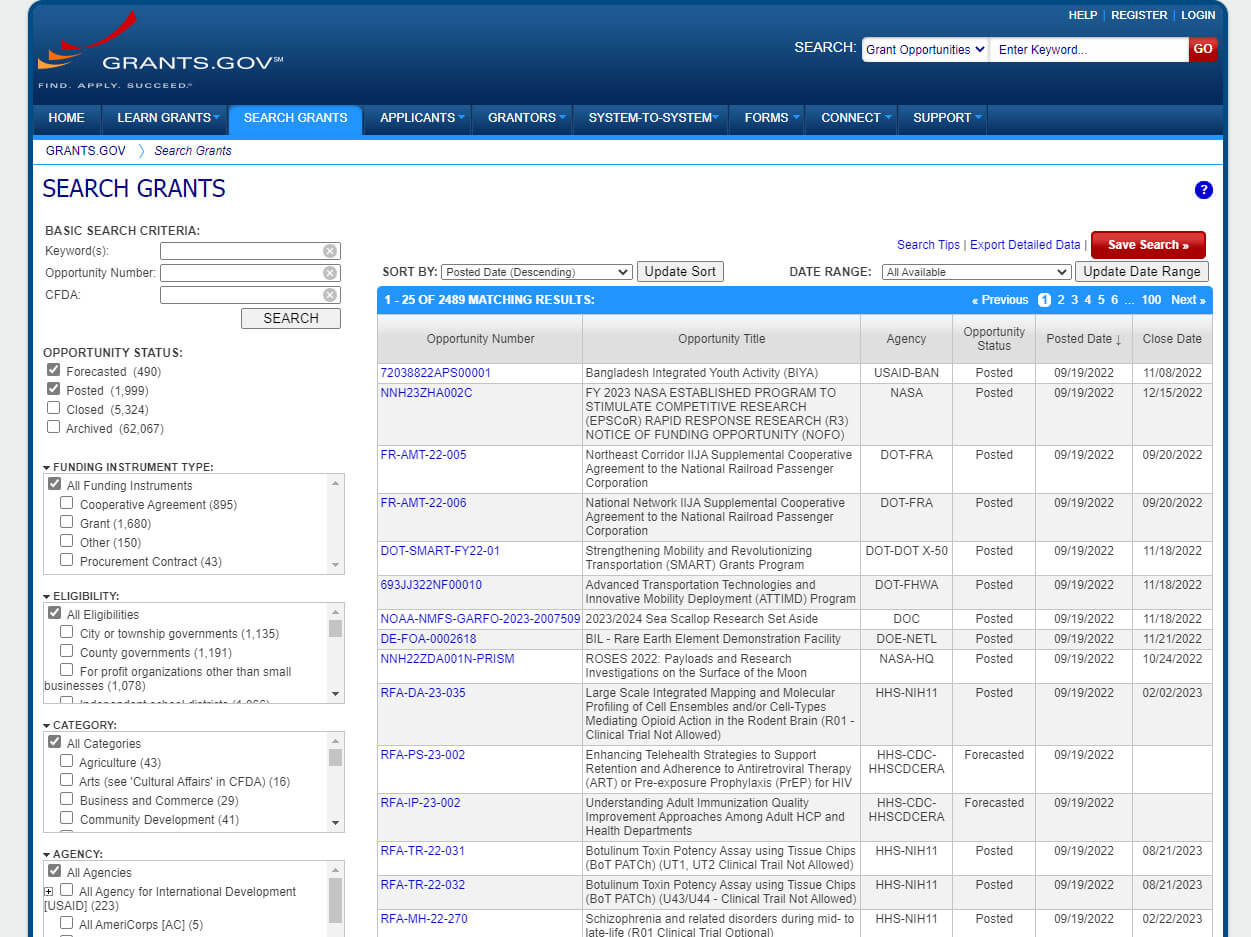

While much more broad, https://www.grants.gov/ is a government funded website that has thousands of grants open to those who are eligible. A quick search of the term, “Veteran” reveals a large number of possible grants.

The grants offered here are always changing and updating. Be sure to check every day to see what you can apply for based on your qualifications!

Beyond this, there are many organizations devoted to helping veterans obtain business grants. These require a bit more vetting but can be very helpful, a popular example is http://freegrantsforveterans.org

Grants take time to research and apply for, but the results can prove invaluable to ensuring your business has a future.

Back