Credit is a tricky and sometimes difficult thing to manage. Dense and often with little instruction; credit can feel pretty overwhelming, especially as you start your business.

There are a few small credit tricks that can help you though!

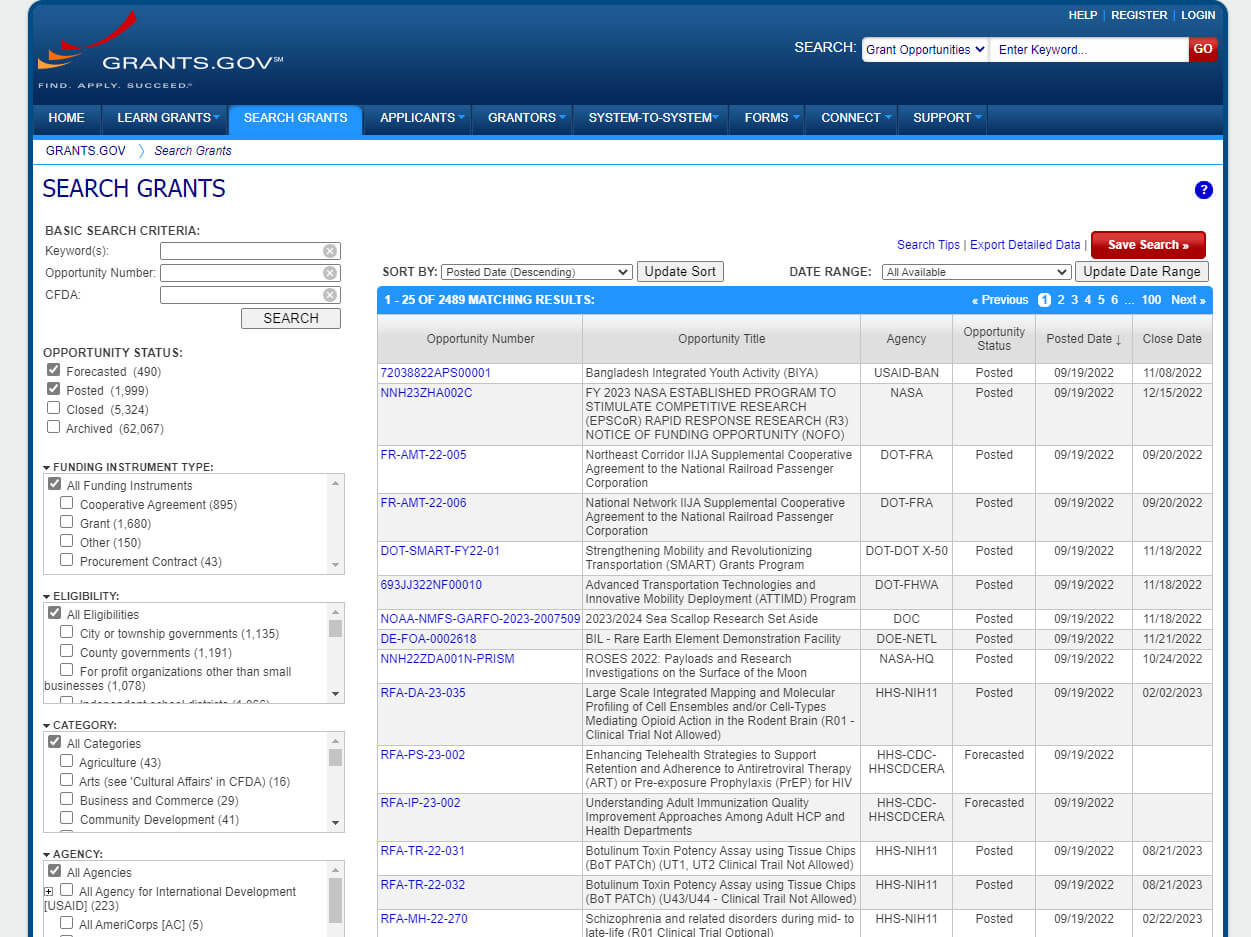

A little known trick is about opening credit cards for your business. Every card you open hits your credit score and affects your ability to apply for other cards. However, what most people don’t know is that credit checks for cards don’t hit instantly; they take a few days. Thanks to that window, applying for more than one credit card in a day is possible and all the applications will use the score when you applied.

This can help you to obtain the funds needed to really get your business off the ground. Just be sure that you can pay back the monthly minimums as they come in.

A bonus to this is that credit cards can often include some bonuses or perks upon sign-up. While none of them are consistent, they can be bonus cashback or additional funds when making purchases. Used properly, they can all be leveraged to put you into a better position to make the needed purchases for your business.

Back